“How much debt is too much for youngsters?”- Have you ever thought about this? Well, it is better to avoid too much debt to stay away from financial stress.

I feel that if youngsters are focusing only on repayment of debt then this is the sign of too much debt. If you are using more than 40% of your monthly income to pay off your debt then you are in too much debt. But there are many other warning signs for too much debt.

In this current blog, I’m going to make you aware of how much debt is too much for youngsters. So make sure you do not overindulge in debt.

How Much Debt is TOO MUCH for Youngsters?

Well, there is no hard and fast rule to say how much debt is too much for youngsters. But there are many warning signs that say about too much debt.

In general, if you are using your most of the income to pay off your debt and not able to save money then this is too much debt.

17 WARNING SIGNS that You Are in TOO MUCH Debt

Analyze these 15 crucial factors that reveal about your debt status. You should not ignore these warning signs if at all you want to lead a happy debt-free life.

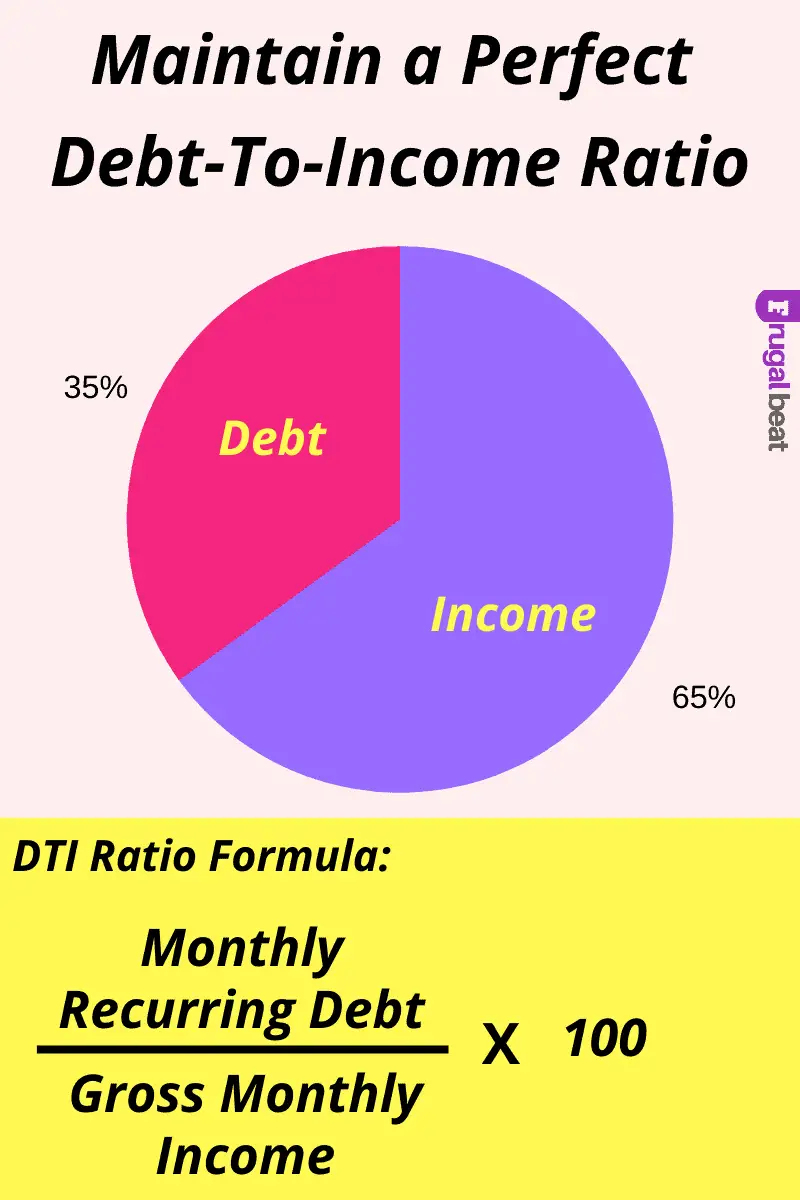

1. More than 35% of Debt-to-Income ratio is Too Much

DTI (debt-to-income) ratio calculation is very important. This is a simple calculation of your debt ratio. The formula to calculate DTI is recurring monthly debt divided by gross monthly income. If this results in more than 35% of then your debt is too much.

So make sure you maintain the ratio very carefully. Your DTI ratio should not cross 35%. That means either you should reduce your debt or you should try to increase your income to balance this ratio.

2. Know How Much STUDENT LOAN is Too Much

Planning your career is very important. And you should know in the beginning only about your future opportunities in your career before applying for student loans.

One can’t predict salaries and earning in the future days, but at least you should calculate it roughly so that you should repay your debt smoothly. You should pay off your student loan with your first year’s salary. If you are not able to pay off with your first year’s salary this student loan is too much debt for you.

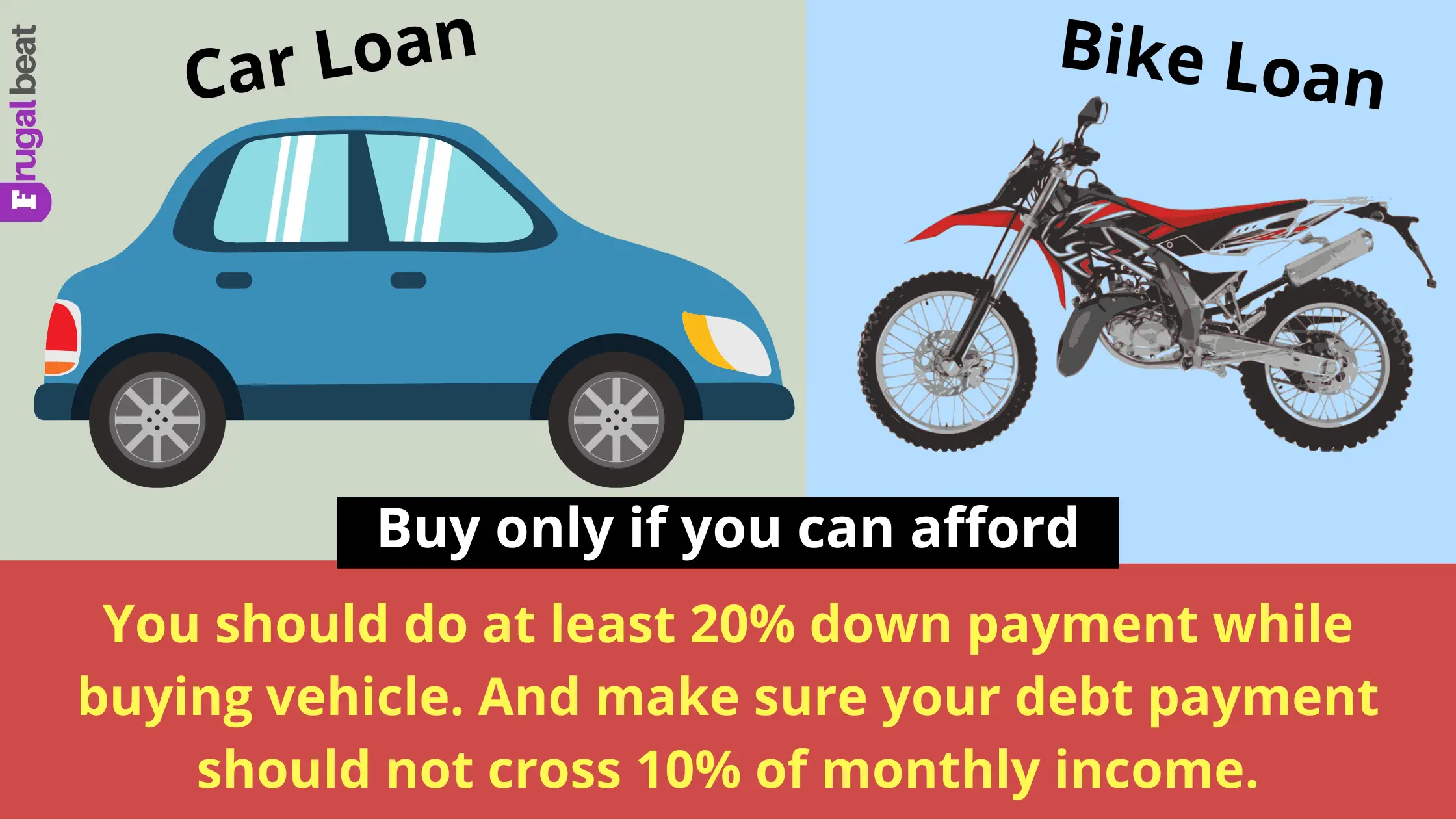

3. Auto Loan is Too Much if you pay MORE THAN 10% OF YOUR INCOME

I’ve seen that many people have car loans. Most people like to have their own vehicle even if they can’t afford. This ends up in auto loans.

The first thing is that if you can’t pay at least 20%-25% down payment then you can’t afford this loan. And if you can afford then your monthly repayment should not be more than 10% of your income. Also, you should be able to pay off the whole amount in less than 5 years.

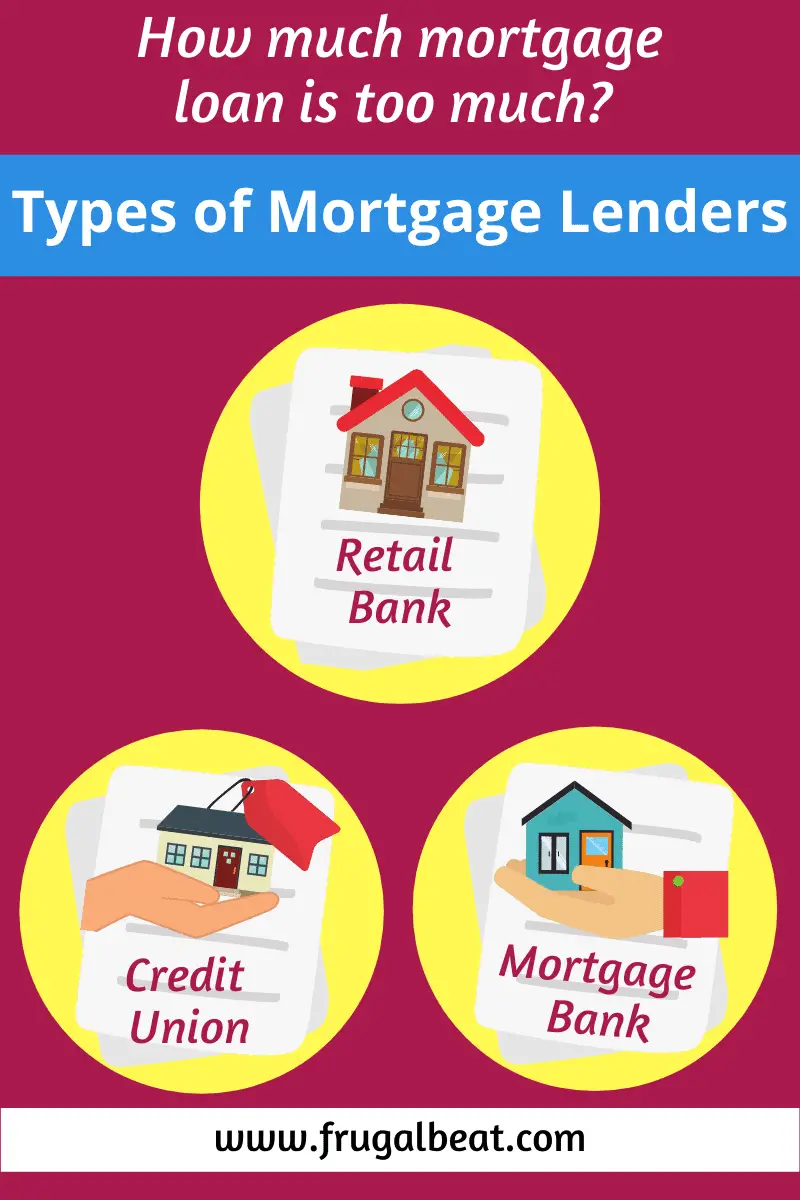

4. Know how much MORTGAGE LOAN is too much

If you want to buy a house then it is always good to check that cost should not be more than 2.5 times your annual income. And here also you should be able to pay a 20% down payment.

Make sure your monthly payment should not exceed 28% of your monthly income from all the sources. If this limit cross that means your debt is too much. And you may face unfavorable situations to pay off your debt.

5. Too much CREDIT CARD Debt

If you ask me how much credit card debt is too much then I would say having more than or credit card is too much. I feel that one credit card is enough.

And if you can not pay off the whole credit card debt within 12 months then you are having too much debt. Well, you do not need to make any purchases just because you are having a credit card. Think twice before swiping your card.

6. Using PAYDAY LOAN seems like too much debt

A payday loan is a small amount of loan that is actually less than your monthly salary. And you promise to pay off this loan immediately after receiving your next salary. If you are opting for payday loans, this is the sign of too much debt.

You are having a lot of debts and you are not able to save money even for essentials till the next salary day. I feel this is actually too much loan because you may require a payday loan every month to handle your monthly expenses.

7. Not able to have $1000 for Emergency Fund

Saving money is really necessary and important. You should always contribute some part of your salary for an emergency fund. If you are living in countries like the US, UK or Canada then you should have a $1000 emergency fund.

If you do not have this emergency fund and even if you can not save 1000 dollars within the next 3 months then you are having too much debt. Yes, if you are not able to build this minimum emergency fund that means your most part of income is being used only for repayment of loans.

8. Creditors are calling you often

If you find your creditors’ name in your phone call list often rather than your best friend’s name then you have too much debt!

Usually, credit agencies call often when the due date is over. So make sure you pay off all the debt timely. If you are not able to pay off monthly payment and getting calls from your creditors that means you are in too much debt.

9. You are not able to make more than a MINIMUM PAYMENT

Minimum payment means usually paying off the monthly interest on your debt. If you are hardly paying off only minimum payment and not able to pay off a part of the principle then you are carrying a huge debt.

So you must always be careful before choosing debt for you. You should calculate how you will pay off your debt quickly. If you are not able to pay off more than minimum payment this reflects that you are having too much debt.

10. BORROWING loans to pay off OLD DEBTS

In my real life also I’ve seen some youngsters who opt for new debts to clear old debts. If you are also doing so, this is the clear sign of too much debt.

Well, there are many other ways to pay off debt quickly by earning extra money. So I suggest not to opt for new debts to pay off old debts. This will result in still more debts in your life. And you may not be able to come out of debt easily if you go on opting for new debts.

11. Net Worth is LESS than ZERO

Balance your assets and liabilities. In simple words, your debts should not be more than your assets. That means your net worth should not be negative.

If your net worth is less than zero then without any doubt you are having too much debt. And this situation actually dangerous. So you should pay attention to your all the debts.

12. Getting charged ‘over-the-limit fee’ on credit cards

There are some rules to use your credit cards. So if you are overusing and using more than the limits then you will have to bear the extra fees.

And if you are frequently paying fees for over-the-limit, you have too much credit card debt. So you should set your own limits to avoid too much debt. Use your credit cards carefully and never opt for too much debt. If you have a credit card that does not mean that you have to use it every time.

13. Struggling to pay your MONTHLY BILLS and on essentials due to debt

No matter whether you have a student loan or any other debts, too much debt is really stressful. If you are not able to pay your bills and not able to manage money for monthly essentials you are having too much debt.

Every month if you pay off your debt and at the end of the month if you struggle to pay a grocery bill or utility bill then you are carrying too much debt.

14. Credit card PAYMENT is MORE than the mortgage

Usually, the mortgage loan amount is higher than credit card payments. But if you are paying off more credit card payment than a mortgage that means your debt is too much.

So if your overall credit card payment is more than your mortgage then now it’s time to be serious about your debt. I say never ever create such a situation where your credit card payment is too much.

15. POOR Credit Card Scores

Credit card scores define your credit status. If you use a credit card too much and do not pay off on time then your credit scores will be low. This is the sign of too much debt.

You should pay attention to your credit scores by being aware of your expenses. Maintaining good credit scores have their own advantages. So do not opt for too much debt through your credit cards.

16. If You are SKIPPING YOUR PAYMENT, You Have Too Much Debt

When you start to skip your monthly payment of a debt that means you are not able to handle that debt. You are having too much debt.

So always live below your means by being frugal and try not to skip any debt payment. If you do so, then you will have to pay extra interest and your debt will go on increasing.

17. You are NOT SAVING MONEY even if you get advance salary

If you ask for advance salaries and even if you are not able to save money every month, you are having too much debt.

That means, you are paying off debt with your advance salary but still, you struggle to come out of debt. This type of life includes a lot of financial stress. You feel like you will never have financial freedom in life. So do not walk on the path of debts that closes all the doors of financial freedom.

How Too Much Debt Can Ruin Your Life?

If you are not giving attention to your debt then you will end up carrying too much debt. You may struggle throughout your life to be debt-free.

Too much debt can ruin your life and happiness.

You will lose your good night’s sleep due to financial stress. And also debt can cause emotional imbalance a well as harm your relationship. After all financial health is very important in life.

If you are carrying more debts then you will not be able to save money for your retirement plan. All your monthly income will be used to pay off your huge debts. So always avoid having too much credit.

How to come out of too much debt?

Well, prevention is always better but if you have stuck with too much debt then prepare a kickass strategy to come out of it. There are some effective ways to pay off debt even with less income.

But at the same time, you should figure out the ways to earn more money to pay off your debt fast. You should first pay off the debt that has a high-interest rate. And follow the rule one debt at a time while paying off debt. Don’t try to pay off all types of debts at a time.

Debt-free Life is a Happy Life

I always say ‘no’ to debts. So I’m living a happy debt-free life in my 20s. But I can understand that some people opt for debts due to unfavorable financial situations. Still, you have a choice to limit your debt.

You should not opt for debt until you are not left with any other choice for you.

So you might have got a clear idea about how much debt is too much for youngsters. Now you should be able to be more sensible when it comes to debts. Do not create a situation where you will not be able to handle your credit score and debts.