Frugal living mistakes to avoid are something that I analyze now and then. If you are doing such mistakes unknowingly, it’s time to know and avoid them.

Frugal living works in your favor if you understand it better. It’s fine to make mistakes. But if you go on doing many frugality mistakes, it harms your personal finance. So, don’t ignore it.

In my current blog, I bring your attention to frugal living mistakes that you should be aware of and avoid at any cost.

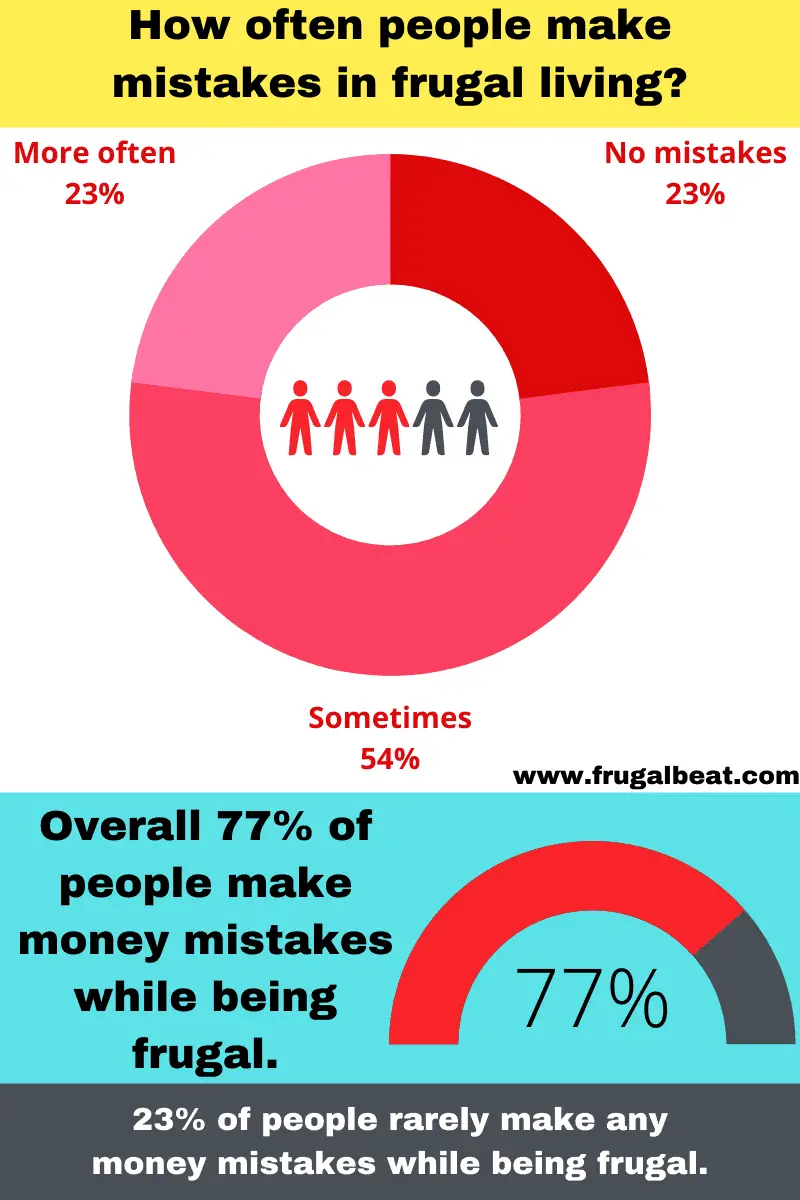

I’ve conducted a survey to figure out how often people make money mistakes while adapting to a frugal living.

29 Common Frugal Living Mistakes to Avoid and Stand-Out

In my recent survey, I found that more people are doing money mistakes. Don’t be a part of 77% of the people who make money mistakes while trying to be frugal.

29 Frugal Living Mistakes that You Should STOP RIGHT NOW

No one wants to lose their money. And you probably want to make your overall life better by adapting to a frugal lifestyle. But if you do these 29 mistakes you are on the wrong track.

1. Sacrificing hobbies in life to SAVE MORE

I believe that hobbies keep us chirpy. So don’t ignore hobbies just because you are adapting to frugality.

Frugal living should make your life better but not worst. If you like painting go and buy a painting kit. If you like playing guitar, go buy it. Don’t sacrifice your hobbies to save a few bucks at the cost of your peace and happiness.

2. Totally cutting off Entertainment Cost

If today you decide to be frugal and cut off the entertainment cost completely, it will not help you. Frugality does not mean avoiding entertainment completely.

If you like watching a movie once in a while, go and spend a few dollars on it. If you want to have dinner at your favourite restaurant, have it once in a while. Let me tell you, frugality is NOT the opposite of enjoyment.

3. Comparing your FRUGAL JOURNEY with someone else’s frugal lifestyle

Comparison destroys your inner peace. Many people try to compare their frugal lifestyle with others. This is not the right approach to be frugal.

Make your own frugal journey meaningful without comparing it with anyone else. Remember, your lifestyle, your earning, your necessities are completely different from others.

4. Involving too much in DIY HACKS to save a few bucks

DIY (Do it yourself) hacks make you more independent by improving your skills. It also saves you money as you don’t need to pay others for work. But there is a limitation in this.

Don’t try to do everything by yourself. If you try to learn each and every skill you will run out of time also you lose money. So, follow DIY hacks based on your nature, internet and need.

5. BUYING too many groceries at once

Many times even I advise people to save money on groceries. That does not mean that you should overindulge in this.

Make sure that you don’t buy perishable goods in bulk. This will

6. Wasting a lot of time looking for COUPON CODES

Are you someone who is spending hours just to get a coupon code? Ask yourself it is worth the deal.

If you are buying really something expensive and looking for a coupon code then that’s fine. But just to save a dollar or two you are spending too much time, you should avoid such a mistake.

7. Looking at the only PRICE while buying second-hand products

I agree that second-hand products will save you a ton of money. Even I’ve purchased some second-hand products and have saved extra.

But you should not consider the price only while buying second-hand products. Many times when you buy such things you will end up paying extra for repair work again and again.

8. Buying things for FUTURE USE by Assuming You Need Them

If you are buying a summer collection to use after a year that’s not a good idea just because of the price drop. And if you are buying something just by thinking you may need that in future is not that good plan.

There is a difference between ‘actual need’ and ‘may need in the future’. So prioritize only actual needs.

9. Only focusing on saving without thinking about PASSIVE INCOME

I always say that frugal living is not just about saving money but also about increasing income sources.

If you are only focusing on saving, you are missing out on some amazing earning opportunities. Never ever do this mistake.

10. Picking up the CHEAPEST product from the shelf while shopping

Looking at the price tag is surely a part of frugal living. But this does not mean that you should always pick up the cheapest product.

Don’t assume that making cheap purchases is all about frugality. Let’s learn to be frugal without being cheap.

11. Buying really LOW-QUALITY food items

Compromising on the quality of food is not something that I recommend to frugal people. Economic living does not mean that you should compromise on important things.

If you ignore the quality of food that you are buying just to save two dimes, it’s time to stop now.

12. Expecting kids to be EXTREMELY FRUGAL

Teaching kids about frugality and the value of money is the responsibility of parents. But if you start to be too strict it will not work for you.

Children want to explore a lot of new things and their growth depends on it. If you are not allowing kids to explore worthly things just to save some bucks, you should re-think.

13. Thinking to Deprive yourself

Most of the time beginners who adapt to frugality have a mindset to deprive themselves a lot. But frugal living is the art of saving money without depriving yourself.

You are NOT expected to become like a monk by avoiding pleasures. If you go on depriving yourself it’s not at all good either for you or for your financial health.

14. Walking 10 miles to buy LOW PRICE products

Walking or driving a car extra miles to bag the products from the market at a lower price is actually a waste of money.

If you get the same type of product in the nearby local store at a little bit high price then just buy it. You should remember that you are going to waste fuel if you go on driving miles to look for cheap products.

15. Suddenly changing your lifestyle to Frugal Lifestyle

If you have a habit of spending more and suddenly decide to apply frugal tips in all areas of life, you feel frustrated.

You don’t need to be so hard on yourself. Your goal should be to adapt to frugality step by step. So don’t do this mistake to decide to change your lifestyle quickly to a frugal lifestyle.

16. Every time buying USED ITEMS

Used or second-hand products are not suitable in every situation. Sometimes you will really regret bringing home used items.

And you should never buy used products such as helmets, mattresses. They are related to hygiene. If you buy such used products you may face health issues and end up paying medical bills.

17. Compromising on Buying Personal Hygiene Products

Frugal living should not affect your life adversely. You have to maintain the quality of life while being frugal.

You don’t need to make compromises on buying personal hygiene products. You can reduce the expenses on any other things by planning your budget well.

18. Using FREE things even if you don’t need them

No doubt ‘free things’ save money. But in reality, you have to analyze if that is worth your time and energy.

For example, getting a free subscription to entertainment for a month. And you’re spending day and night exploring this free entertainment for 30 days. This is not worth it.

19. Waiting too much to crack good deals at a low price

If you need a laptop to work from home and you are waiting for the past 5 months for the price drop, it’s not frugality.

In this case, you have already wasted 5 months. Whereas you could buy a laptop and earn 5 months income. If you don’t buy the things that you need, it will cost you too much.

20. Not selling out old and unwanted things that you don’t use anymore

Some people get attached to things even if they are don’t need them anymore. Stop storing and collecting things just because you have paid for them.

You can think about selling the old things and earn some money.

21. Taking MORE STRESS in the race of Being Frugal

Financial stress is something that everyone should pay attention to. Making the right kind of budget plan will help you reduce such financial stress.

If you are taking too much stress about how to be more frugal every second, it will affect you badly. So, take action in the right way.

22. SPENDING just because you are getting it at a low price

If you see any product or service that is available at a low price that does not mean that you have to buy it.

Many people do this mistake out of their habit. But you should buy only those things that you need.

23. Setting UNREALISTIC Saving Goals

Some people are hurrying in accomplishing money goals quickly. And they try to adapt to frugality in every area of life quickly.

If you are one among them, I advise you to set realistic money goals. Initially take baby steps or else you will get demotivated in the long run if you fail to be frugal.

24. Being a MISER while being frugal

There is definitely a difference between being frugal and being a miser. Being miser will reduce the quality of your life.

Pay attention to adapt to frugality without being a miser.

25. Not encouraging family members to be frugal

Accomplishing money goals is not just your alone’s responsibility. Do not bear the burden alone. It’s not like that you have to be extremely frugal so that your family members can enjoy it.

Make sure all your family members equally contribute towards a frugal lifestyle. Avoid getting into the trap that it’s your alone’s responsibility.

26. Not making any INVESTMENT due to fear of losing money

When I save money as a frugal person, I invest it by taking calculated risks. I can understand that you have saved your hard-earned money by adapting to frugality. But don’t keep your money idle.

Invest money so that you can grow your wealth. Don’t allow your fear to lose the opportunity to build wealth by investing. Take calculated risks.

27. Buying quickly when you see a PRICE DROP

It tempts a lot of frugal people when they see a ‘price drop’ advertisement. At such a moment don’t buy immediately.

Change your impulse buying behaviour when you see the price drop on any product or service.

28. Not Investing in Learning Skills or Education

If you learn new skills in your field that will help you to build a good career. It’s good to avoid overhyped courses that will not add value.

But at the same time, you should know that you should always have a learning attitude. It’s fine to invest money to learn some skills that will help you to earn more in the long run.

29. Always Paying Cash Rather than Paying with Cards

When you make payment with hard cash, you know exactly how much cash you have in hand. This helps you to be sensible while making purchases.

But this will not work well every time. There are many offers related to credit and debit cards. So, if you pay with cards then you can get points and discounts too. Ignoring cards every time is not a good idea.

I’ve Learned From My Money Mistakes that I Used to Make Earlier

I was also completely a beginner once when it comes to frugal practices. I’ve learned from all my money mistakes that made me lose my money. In these above-explained mistakes, I’ve also done some of these mistakes.

Now I don’t do such mistakes again and again. Now I know how and where to apply frugality to save money. You should also correct your money mistakes before it’s too late.

Pay attention to such frugal living mistakes to avoid any huge losses in life. Frugality should build your wealth and improve the quality of your life.