“How to manage money in your 20s?”- Is this question popping up in your mind? Well, managing money is an art. When you implement practical ways to manage your money you will start to excel this art.

I’m someone who has left the job to pursue my dreams. Now in my 20s, I’m stepping towards my dream without spending big bucks. I’m adapting frugality in my life.

Many of you may feel that managing money in the 20s is a burden for you. But in reality, money management is an art which you can enjoy:) Yes- I’m also taking simple steps to be frugal and save money.

How to manage money in your 20s?

I’m also in my early 20s. And I can understand that 20s are like “say yes to everything”. What I mean is, when your friends ask you for a movie, party or traveling most of the time you say “yes”. Who thinks about money and spending habit at this time?! Right?:)

But this is the right time to think about money management. If you say “yes” to everything now, then you can’t grow financially. A sensible person always knows when to say ‘no’ politely.

I’m not saying you to completely avoid parties, movie and all. Well, who doesn’t like fun and enjoyment in 20s! But one should learn to balance the saving and spending habit.

How to learn the art of managing money?

I believe in real life practical learnings. I’m learning about managing my money by observing my spending habits. I’ve inculcated saving habit since my childhood.

I was getting a few coins as pocket money from my parents. I used to add them to my piggy bank. This saving habit taught me to manage my money.

I can’t say that I’m totally good at handling my money in my 20s now. But daily I’m experimenting practical ways to save money. Trust me, once you adapt frugality in life, you will start to figure out ways to save money on a daily basis. Saving habits help to build wealth.

10 simple ways to manage money in 20s by adapting frugality

Frugal living does not mean being cheap or miser. To manage money you are not required to compromise on everything. You are not required to be miser to save more money. You should make smart moves with money.

Let me elaborate on some practical ways about how to manage money in your 20s-

| 1. Read money-related books in your 20s to understand money management |

| 2. Know how to utilise your money properly in your 20s |

| 3. Be clear about your financial goals |

| 4. Don’t blow your money in your 20s |

| 5. Avoid addictions in your 20 |

| 6. Don’t plunk down your money on dating in your 20s |

| 7. Know the difference between being cheap and being frugal while managing your money |

| 8. Know how to manage money in your 20s which saves money on transportation |

| 9. Start adapting towards minimalism in your 20s |

| 10. Share your financial plans and goals with your family in 20s |

1. Read money-related books in your 20s to understand money management

If you ask me about how to manage money in your 20s, I say- read about money matters. In my teenage, I was reading only my textbooks! I was not reading any other books. But now in my 20s, I’ve learnt how other books help to grow my knowledge about finance.

Few of my friends like reading books like fiction and non-fiction books. I’ve got inspired by these friends and started reading books. I prefer reading books which help me to grow in my life.

Which books I’ve read in my 20s which are helping me to manage my money?

The first book which I’ve read is “Rich Dad Poor Dad”. In this book, the author shared his real-life about how he managed his money. By reading this book I’ve realised the difference between assets and liabilities. This book is written in a very simple way that even a teenager can read and understand money management very easily.

Then I’ve read other books also which are about money management- “Think and Grow Rich”, “The Richest Man in Babylon”. These are all written by successful people in the world. All these good books tell about how to save money. And these books helped me to create the right kind of money mindset.

2. Know how to utilise your money properly in your 20s

Managing money is not only about saving money. It is also about how to utilise your money properly. Wrong cash flow will not help you to grow financially.

So, grab all the opportunities where you can invest in yourself which helps to get the highest returns in future. Here what I’m trying to say is, invest money on the right things like books, professional course, personality development etc.

How I utilise my money?

I’ve invested my money in learning skills like computer, typing, accounting, etc. You can also acquire any skills which will help you to grow professionally. Such as learning a new language, speaking English, communication skill etc.

These are all very beneficial skills which will help you one or the other way. Invest money to build a particular skill is all about using your money wisely. But I never invest my money on any course just because my friends have opted any particular course.

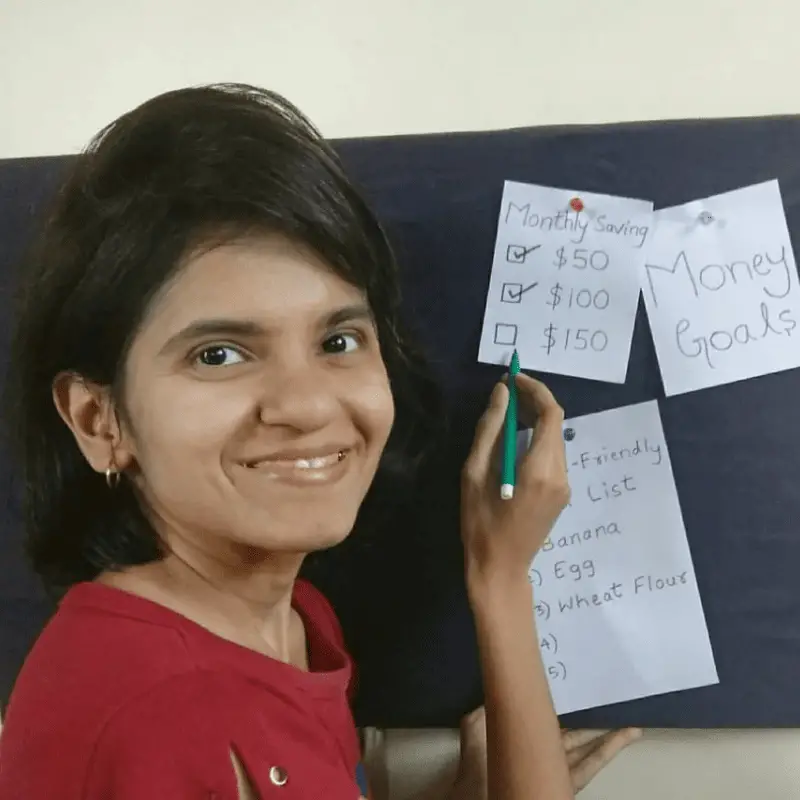

3. Be clear about your financial goals

If you ask me about my savings/financial goals, I am able to define my financial goals. I can not say that right now I have a perfect financial plan. But at least I have a rough calculated financial plan.

When I asked my friend cum colleague about her monthly saving goal. She gave me a reaction as if ‘saving’ word was not there in her dictionary! But when I was doing a job, my monthly saving goals were absolutely clear i.e. 70-80 percent savings.

Well, I had a strong reason to save 70-80 percent of my regular income. I did not want to do a 9-5 job. I always wanted to follow my passion, my dream. So I managed to save more money.

How to set your financial goals?

Now you may think that to manage money you should have a regular income. But let me tell you, even teenagers are learning to save money without a job. So, don’t give excuses for setting financial goals.

Even in my teenage I saved money and opened my bank account. So, set your financial goals even if you are a college-going student and not having any regular income. And be practical while setting your financial goals.

You know, when you set financial goals, ideas will pop up in your mind to accomplish the goals. My friend is very good at art and craft. And during college days she used to sell her crafts to classmates and earn money. This is how she managed to save money as a student. Like this, you can figure out ways to make money and save.

4. Don’t blow your money in your 20s

Are you blowing your money on stupid things? Like – watching each and every movie in a theatre, giving costly gifts on your friends’ birthdays? Well, if you have bad spending habits, now you should bring your attention to your spending habits.

I’ve seen that in the 20s most of us can’t handle peer pressure. This results in blowing money on stupid things. So, here I say- don’t buy costly gadgets just because your friends have them. Buy only those things which are necessary.

How to overcome peer pressure to avoid wasting money?

If all of your friends are rich and they spend a lot of money. Then you can think about making new friends now. I really feel that we should have good friends who push us towards growth. But wrong friend circle will be a barrier for your financial growth.

Avoid shopping with friends. This will help you to pick only the necessary things. Whenever your friends ask you for shopping learn to say ‘no’ politely. The best practical way is, have at least one friend who encourages you to save money. Talk to that friend about money related matters and also learn from him/her to manage your money.

5. Avoid addictions in your 20

I’m not talking about any serious type of addictions like smoking, drinking. Well, no doubt these addictions are definitely not good for your health as well as wealth. Well, I found a new type of addiction among youngsters which is internet addiction.

Yes, people are so addicted to the internet that they are ready to pay huge internet bills. And there also other addictions like eating chocolates. I’ve realised that some of my friends are addicted to eating pizza!

Here what I’m trying to say is- even simple spending habits like spending money on chocolates and outside food can be dangerous to your wallet. So, avoid frequently spending money on such things.

First, learn to manage your money on simple things like this. These simple steps help you to cut down your expenses.

6. Don’t plunk down your money on dating in your 20s

Are you finding your romance partner in your 20s? Well, usually in 20s people try out dating. And they spend a lot of money on gifts, food, entertainment like movies, pubs etc.

But I think spending money on date is optional. And you don’t need to spend a lot of money to impress the person. Don’t date a wrong person where you end up making hole to your pocket.

7. Know the difference between being cheap and being frugal while managing your money

Saving money is really a good habit. But whenever you think about how to manage money in your 20s, you must know the difference between being cheap and being frugal. You know what, being cheap can also help you to save money but it won’t last forever.

Let me explain you with an example. If you buy any second-hand laptop at a lower price. Which is a very old model, Then here you may save money now. But in future, you are going to spend a lot of money on repair.

So, if you are buying anything for regular use which you really need then choose durable, good quality products. Instead of buying an old laptop, you can search for offers on a new laptop. So, one must adapt frugality in life to save money.

8. Know how to manage money in your 20s which saves money on transportation

I’ve seen that during teenage itself people start to learn riding a bike, driving a car. And ultimately they plan to buy their own vehicle. But I feel, in 20s one does not actually need own vehicle.

I’ve seen my cousin who has his own vehicle. He never goes anywhere by walk (even if the place is very near). Maybe you have also observed this thing. When one has own vehicle, he/she always take a ride on it. By this, they end up wasting money on fuel. And additionally, there are other expenses also like insurance of vehicle, servicing, repair etc.

So you can use public transportation instead of spending a lot of money on your vehicle and fuel. You can also follow other things like sharing a ride, carpooling.

9. Start adapting towards minimalism in your 20s

Minimalism is all about having less things (which are really necessary). While buying any products always ask yourself 3 questions –“Why I need this?”, “Is this really necessary?”, “Is this worth buying?”. Practice following these questions every time while spending money on new things.

Minimalism is the key to conserving the planet. Minimalism is the key to a more wholesome living. Minimalism is the key to eternal happiness. The sooner you adapt to minimalism, the better it will prove for you. Minimalism helps you to know how to manage money in your 20s.

10. Share your financial plans and goals with your family in 20s

Well, there should not be any communication gap between you and your family when it comes to financial goals. If you’ve your family support to achieve your financial goals then this is your plus point.

For this first, I would like to advise you to note down your financial plans and goals. While sharing your financial plans with your family first you must have practical and simple plans. Then only your family can support you in that.

If you are thinking about how to manage money in your 20s, then you are on the right path. Not everyone takes the right decisions in 20s. But if you are adapting frugality in your 20s then I must say you are wise enough to choose what is right for you.